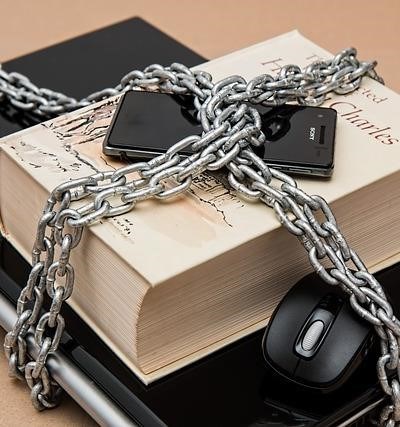

Buying musical instruments can be expensive․ Whether you’re a seasoned pro or just starting, financing your music equipment purchases is often necessary․ This guide helps you navigate the world of credit cards, focusing on securing the best low-rate options for your musical needs․

Understanding Your Financing Options

Before diving into specific cards, let’s explore your options․ You might consider musical instrument financing directly from retailers, offering payment plans for instruments or instrument loans․ However, credit cards provide flexibility and can be used for various music-related expenses beyond instruments themselves․

Choosing the Right Credit Card

The ideal card depends on your credit history and spending habits․ Let’s examine key features:

Low APR Credit Cards: The Foundation of Smart Financing

A low Annual Percentage Rate (APR) is crucial․ High interest can quickly negate the benefits of any rewards․ Look for low-interest credit cards or even no-interest credit cards for introductory periods, allowing you to pay off your music equipment purchases without excessive fees․ These are particularly beneficial for larger purchases like a new guitar or keyboard․

Credit Cards for Musicians: Tailored Benefits

While not always explicitly labeled «credit cards for musicians,» some cards offer benefits that indirectly aid musicians․ Consider rewards credit cards for music that provide cashback or points on entertainment spending, which could include concert tickets, music lessons, or online music services․

Best Credit Cards for Beginners: Building Your Credit

If you’re building your credit, securing a best credit cards for beginners with a low credit limit and responsible usage is paramount․ This helps establish a positive credit history, allowing access to better cards in the future for larger musical instrument financing needs․ Remember, responsible use of cheap credit cards is key to avoiding debt․

Prioritize Affordable Credit

Ultimately, the goal is affordable credit․ Compare APRs, fees, and benefits carefully․ Avoid cards with high annual fees that eat into any potential savings․ Read the fine print! Understanding the terms and conditions protects you from unexpected charges․

Tips for Smart Credit Card Usage

- Pay on time, every time: Late payments drastically damage your credit score․

- Keep your balance low: Aim to pay off your balance in full each month to avoid interest charges․

- Monitor your spending: Track your expenses to avoid overspending and stay within your budget;

By carefully considering these factors and choosing a card that suits your financial situation, you can make smart financing musical equipment decisions and focus on making beautiful music!

This is an excellent guide for musicians looking to finance their equipment purchases. The clear explanation of APR and the emphasis on responsible credit card use are particularly helpful. I especially appreciate the advice on choosing cards based on credit history and spending habits.

This article provides a balanced perspective on financing musical instruments. It correctly highlights the benefits of credit cards while also emphasizing the importance of responsible spending and managing debt. The advice on exploring retailer financing options is also useful.

Well-written and easy to understand, even for those unfamiliar with the complexities of credit cards. The focus on finding the right card for individual needs is spot-on. This is a valuable resource for any musician looking to make informed financial decisions.

A very practical and informative article. The section on low APR credit cards is crucial, as interest charges can easily derail a musician’s budget. The inclusion of advice for beginners building their credit is also a valuable addition.