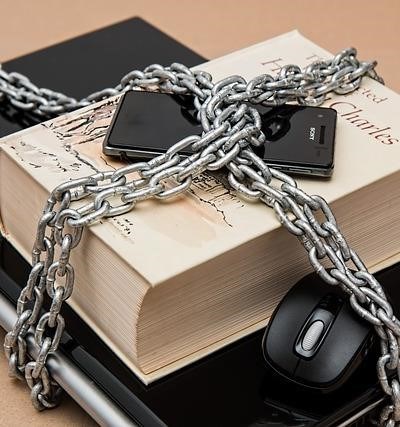

Businesses relying on non-VBV (Verified by Visa/Mastercard SecureCode) credit cards face heightened fraud prevention challenges. While convenient, these cards lack an extra layer of authentication, making them more vulnerable to credit card fraud and identity theft. Robust risk management strategies are crucial for financial security.

Understanding the Risks

Accepting non-VBV charge cards, business credit cards, or commercial credit cards without robust security measures significantly increases your liability. Without verification through VBV, fraudulent transactions are easier to execute. This exposes your business to potential data breaches, compromising sensitive customer information and leading to substantial financial losses.

Strengthening Your Defenses

- Merchant Services & Payment Processing: Choose reputable merchant services providers offering advanced payment processing solutions with built-in fraud prevention tools.

- Cybersecurity & E-commerce Security: Invest in robust online security and e-commerce security measures. This includes secure servers, firewalls, and regular software updates to protect against cyberattacks.

- Payment Gateways & Transaction Security: Utilize secure payment gateways that offer encryption and other transaction security features. Implement strong authentication and authorization protocols.

- Account Protection & Monitoring: Regularly monitor transactions for suspicious activity. Set up alerts to notify you of unusual purchases. Implement robust account protection measures.

- Reporting & Compliance: Maintain detailed records of all transactions. Establish clear procedures for reporting fraudulent activity. Ensure compliance with all relevant regulations.

Minimizing Your Exposure

While eliminating all risk is impossible, proactive measures significantly reduce your vulnerability. Implement thorough verification processes for online orders, including address confirmation and order tracking. Educate your employees about fraud prevention best practices and the importance of reporting suspicious activity immediately. Regularly review your risk management strategy to adapt to evolving threats.

Secure Payments are Paramount

Prioritizing secure payments is non-negotiable. The cost of a data breach far outweighs the investment in robust security measures. By combining advanced technology with diligent employee training and robust processes, businesses can significantly mitigate the risks associated with accepting non-VBV credit cards.

Excellent resource for businesses looking to improve their fraud prevention strategies. The emphasis on proactive measures and robust security systems is crucial in today’s digital landscape. I especially appreciated the section on reporting and compliance.

This article effectively explains the vulnerabilities of non-VBV credit card transactions and provides a comprehensive guide to strengthening defenses. The step-by-step approach makes it easy to understand and implement the recommended security measures.

This article provides a clear and concise overview of the risks associated with accepting non-VBV credit cards and offers practical, actionable advice for mitigating those risks. The breakdown of security measures is particularly helpful.

A well-written and informative piece that highlights the importance of choosing reputable merchant services providers and implementing strong authentication protocols. The advice on regularly monitoring transactions is also valuable.